REFORM OF CFC’S LEGAL AND TAX FRAMEWORK

In order to strengthen its attractiveness and comply with international best practices, Casablanca Finance City undertook a series of reforms, transforming its legal and taxation frameworks. This reform does not differentiate between local or exporting activities.

The said reforms were carried out based on the application of several legal texts:

The reform focuses mainly, on the following aspects:

- Broadening of eligible activities

- Reinforcement of compliance rules

- Process simplification for granting the CFC status

Following this reform, the rate card for the CFC status has been revised. It has been modified as follows:

- An application fee is paid to CFCA upon filing of the status request. It is calculated based on the type of company as well as its size and total years of activity.

- The annual fee is paid to CFCA before March 31 of each year, following the closing day of the accounting year. It is also calculated by type of company and now includes two variables:

- The nature of the business activity entering into force from January 1, 2022

- Contribution to the development of the CFC in terms of workforce size entering into force from January 1, 2021

To get an estimated rate card for your company, please reach out to your key contact at CFC.

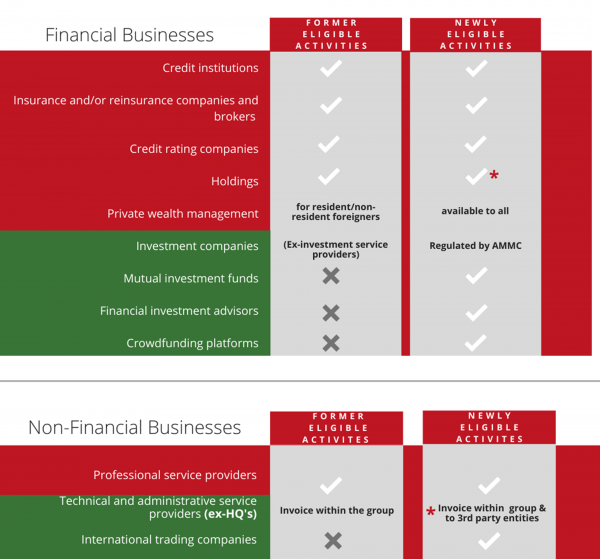

1. Broadening of eligible activities

Following the entry into force of the decree-law on the 1st of october, the CFC status has since opened up to six new business activities: investment companies, collective investment funds, financial investment advisers, crowdfunding platforms, trading companies and regional headquarters of multinational companies. The latter can now invoice transactions for goods and services within the group, and to third party entities. This expansion will allow CFC to increase the flow of investments.

* Holding companies are now considered as Financial Institutions, regardless of the shares they hold in the capital of their international subsidiaries (majority or not).

*Headquarters will now be able to invoice transactions for goods and services within the group, and to third party entities. They are now named “technical and administrative service providers”.

2. Reinforcement of compliance rules

This reform also includes new compliances rules for CFC companies:

- Provide an added value to the development of CFC

- The general manager, must reside in Morocco

- Allocate a minimum of operating expenses in line with the activity of the company

- At least one senior executive must have qualifying international experience

- Minimum of 3 years for service providers (administrative, technical, ancillary, trading)

- Minimum of 1 year for all other activities

In the event that these requirements are not met, penalties may apply as stated by the law.

- 12 month suspension of the CFC status, with possible withdrawal

- Penalty fees for failure to respect submission deadline of annual report

Companies that obtained the CFC status before October 1, 2020, must comply with these new regulations by December 24, 2021.

3. Process simplification for granting the CFC status

The CFC status process has been streamlined for maximum efficiency. CFC Authority assesses and approves the application for the Status. CFCA, then, submits proposals for granting “CFC Status” to the Ministry of finance. For regulated activities, CFCA requests an opinion from the relevant supervisory authority.

The processing of requests is henceforth reduced to a period of 30 working days.

Tax Reform

Another major reform relates to CFC’s tax framework:

- A corporate tax of 15% is applied to all CFC companies, except banks and insurance/reinsurance companies

- The new regime includes the exemption from corporate withholding tax on dividends distributed to residents and non-residents

Transitional period: CFC members still benefiting from the former tax regime must transition over to the new regime by December 31, 2022.

By January 1, 2023, all CFC companies will be subject to the same corporate tax (15%).

*except banks and insurance/reinsurance companies

These new regulations will improve Casablanca Finance City’s value proposition and reinforce its international credentials as a trusted financial hub in Africa

For any questions or additional information, contact us: contact@cfca.ma